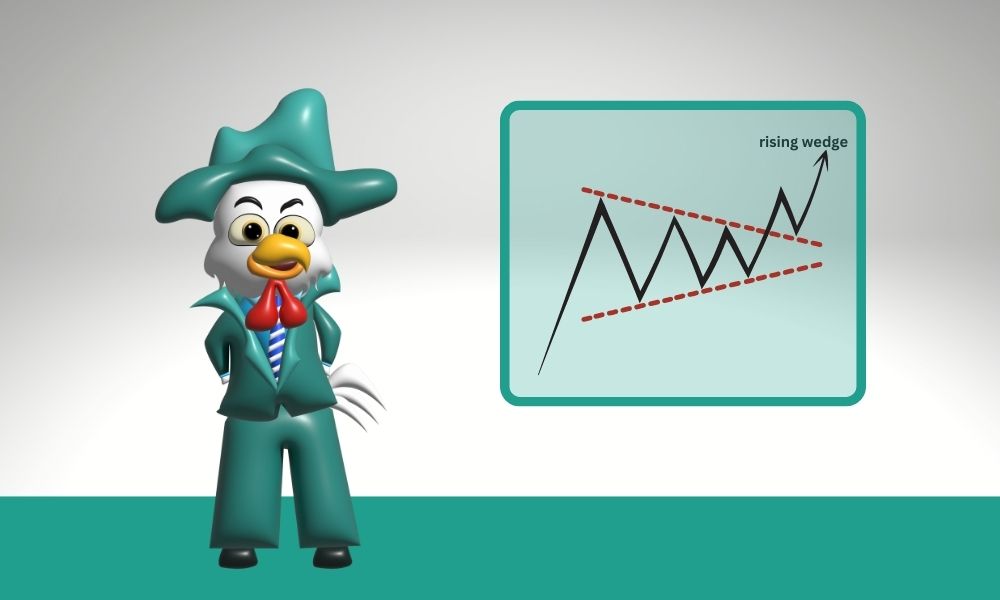

A rising wedge is a bearish chart pattern that is made up of two trend lines that meet in the middle. The trend lines go up and then come together.

The first trend line links the most recent lower highs and higher highs, while the second trend line links the most recent lows.

The shape that was made looks like an upside-down triangle. The pattern of a rising wedge is a falling wedge.

The rising wedge pattern could be seen as a bearish wedge, since the lower trend line is steeper than the upper one and the low is higher than the high.

Even though the falling wedges have the same shape, the angle of the triangle and what the pattern means are the only things that are different.

The rising wedge (ascending) pattern is a bearish pattern because it predicts that prices will go down or that a downtrend will start. The trade volume goes down as the wedge grows.

Even though the wedge still shows that prices are going up, the fact that trade volume is going down could mean that sellers are tightening their positions in preparation for a negative breakout.

On the other hand, the bullish slope of the falling wedge (descending) pattern shows that a near-pattern rebound is coming.

The interesting thing about a rising wedge is that it can show up as a continuation pattern during a downtrend or as a reversal pattern during an uptrend.

Most of the time, the rising wedge pattern comes after long-term trends, which makes it easy to trade cryptocurrencies.

For example, the wedge pattern may show up as a sign that a trend is about to change if it has gone too far too fast.

Strong trends happen when there are more buyers than sellers. At each price, business is going on between buyers and sellers.

When there are too many buyers and not enough sellers, the price must be raised quickly. This should encourage more sellers to join the market.

If the higher price doesn't make more sellers want to sell, the price will keep going up quickly. This quick change leads to strong uptrends that start to bring in more buyers who don't want to miss out on the trend (known as FOMO, or fear of missing out).

Once this strong trend has taken hold and the big crypto whales have stopped buying, which will bring in the FOMO buyers, the price will start to go back up.

Each new high is followed by a new drop, which brings in more buyers. Right now, the market is ready for a big correction because a pattern called a "rising wedge" has formed.