The largest difference between Forex and the stock market is, of course, what you are trading.

Forex, or foreign exchange, is a marketplace for the buying and selling of currencies, while the stock market deals in shares – the units of ownership in a company.

Primarily, your decision about whether to trade currencies or stocks should be based on which asset you are interested in trading, but there are some other factors you need to consider.

Here are the deets...

Liquidity

Liquidity is the ease at which an asset can be bought or sold in a market. It is an important consideration because of the higher the volume of traders.

The more money there is flowing through the market at any time – making it easier for you to find someone to take the other side of your position.

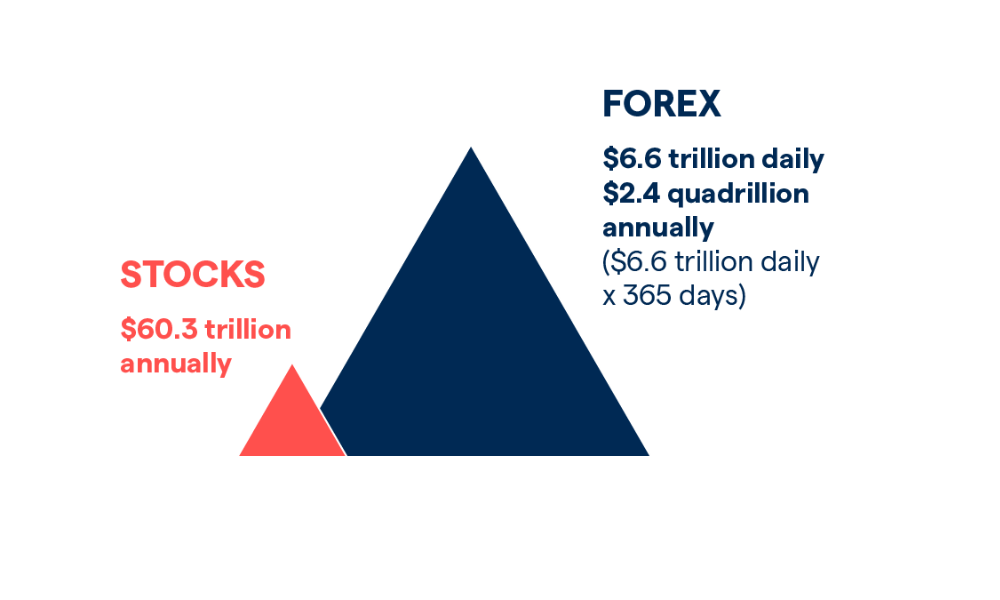

Forex is the largest and most popular financial market in the world, which means it is extremely liquid and frequently sees a daily turnover of trillions of dollars.

Market liquidity can fluctuate throughout the day as different sessions open and close around the world, but it also varies greatly depending on which FX pair you choose to trade.

Just eight currency pairs account for the majority of trading volume – for example, the dollar is involved in almost 75% of all forex trades according to the Bank of International Settlements (2016).

The stock market sees comparatively fewer trades per day, but shares are still easy to access and trade. Large, popular stocks – such as Apple, Microsoft, or Facebook.

These are the most liquid as there are usually willing buyers and sellers, but once you move away from blue chips there is often significantly less liquidity.

Volatility

Volatility is a measure of how likely it is that a market’s price will make major, unforeseen price fluctuations.

A market with high volatility will see its prices change quickly, whereas markets with low volatility tend to have more gradual price changes.

The ease at which Forex can be traded makes it extremely volatile. Though the market will usually trade within a small range, the vast number of trades taking place on the Forex market can cause prices to change extremely quickly.

When trading forex it is important to keep up to date with political, economic, and social events, as the market is prone to sudden and drastic movements in response to these announcements.

The stock market tends to have more stable price patterns that you can track over time. But, like forex, it can see periods of volatility and is especially sensitive to domestic politics.

For example, the Dow Jones fell sharply in March 2018 as American companies suffered from US President Donald Trump’s trade tensions with China.

Trading volatility can potentially provide a lot of opportunities for traders to profit, but it also comes with increased risk, making it important to take steps to prevent unnecessary loss.

Leverage

Trading on leverage enables you to gain exposure to markets with just a fraction of the capital normally required. Leveraged products, such as CFDs, can be used to trade on margin across a range of markets.

Though it can be an advantage of both share trading and Forex trading alike, it is more commonly cited as a feature of currency trading.

Forex traders usually have a much larger leverage ratio, in some countries as much as 200:1. But leverage is a double-edged sword: though it can magnify returns, it can also magnify losses.

Whichever market you choose, it is important to be aware of the size of your exposure and understand the risks involved.

Going Long or Short

When deciding between forex and the stock market, it is important to identify all the opportunities available to you – notably, can you short sell?

The ability to short a market opens you up to a whole new dimension of market movements, enabling you to speculate on both rising and falling markets.

As Forex trading involves buying one currency and selling another, traders have always been able to access falling markets.

When investing in shares, you could traditionally only take a long position, as you’d be looking to profit from any future increase in the value of a company’s stock.

But thanks to derivative products, such as CFDs, you can go long and short on company shares – giving you equal access to trading opportunities whatever the future direction of the market.

Therefore, it's your call!