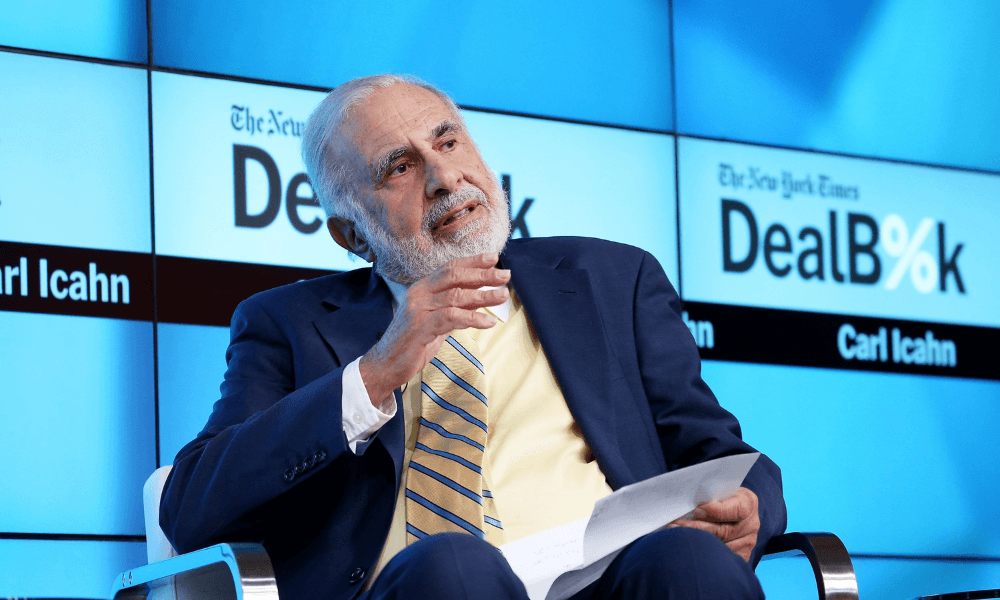

Carl Icahn has sold the last of what was once a 10% stake in energy company Occidental Petroleum, The Wall Street Journal reported, ending an uneasy relationship between the billionaire activist investor and the oil-and-gas producer just as the latter’s shares surge.

Icahn, critical of Occidental’s outbidding of Chevron in a May 2019 deal to buy Anadarko Petroleum with $10 billion of financing from Warren Buffett, had been campaigning for the ouster of CEO Vicki Hollub for almost a year.

When Occidental’s shares plunged in March 2020 — allowing Icahn to boost his stake to 10% from 2.5%, according to the Journal.

Now, Occidental’s shares are surging, more than quintupling in value since they sank below $10 per share in 2020, largely thanks to the recent rise in oil prices.

Its shares closed Friday at $56.15 apiece; that’s just below where they were before the Anadarko deal was finalized, according to the Journal.

Recently, Icahn has been cutting his position in Occidental and he sold the rest of it in recent days, according to a letter Icahn sent to Occidental’s board on Sunday.

Icahn’s two representatives on the Occidental board will also resign, the letter noted, as required by a settlement agreement he had reached with the company two years ago this month.

Revealed In 2022 Revealed In 2022 Best Day Trading Strategies for Beginners |

The Journal, citing sources “familiar with the matter,” reports that Icahn has realized a profit of some $1 billion on the Occidental investment.

Buffett, meanwhile, has been buying Occidental recently. As of Friday, Buffett’s Berkshire Hathaway reported owning roughly $5 billion worth of Occidental stock.

Icahn of late has been focused on smaller utility company Southwest Gas, according to the Journal.

Last week, the energy firm announced plans to separate a subsidiary Icahn had called for it to sell.

- CNBC

More News

U.S. Crude Oil Briefly Tops $130 A Barrel, A 13-Year High On Possible Western Ban Of Russian Oil

Bitcoin (BTC) Treads Water After Brief Visit To Sub-$39,000

Crypto Donations For Ukraine Cross $83 Million Led By Ethereum & Bitcoin